To realize the financial breakeven point, the EBIT is expected to result in a net income of zero. Here is where financial break-even comes in companies will need to understand how they are to generate enough profit after having covered their fixed financial expenses.

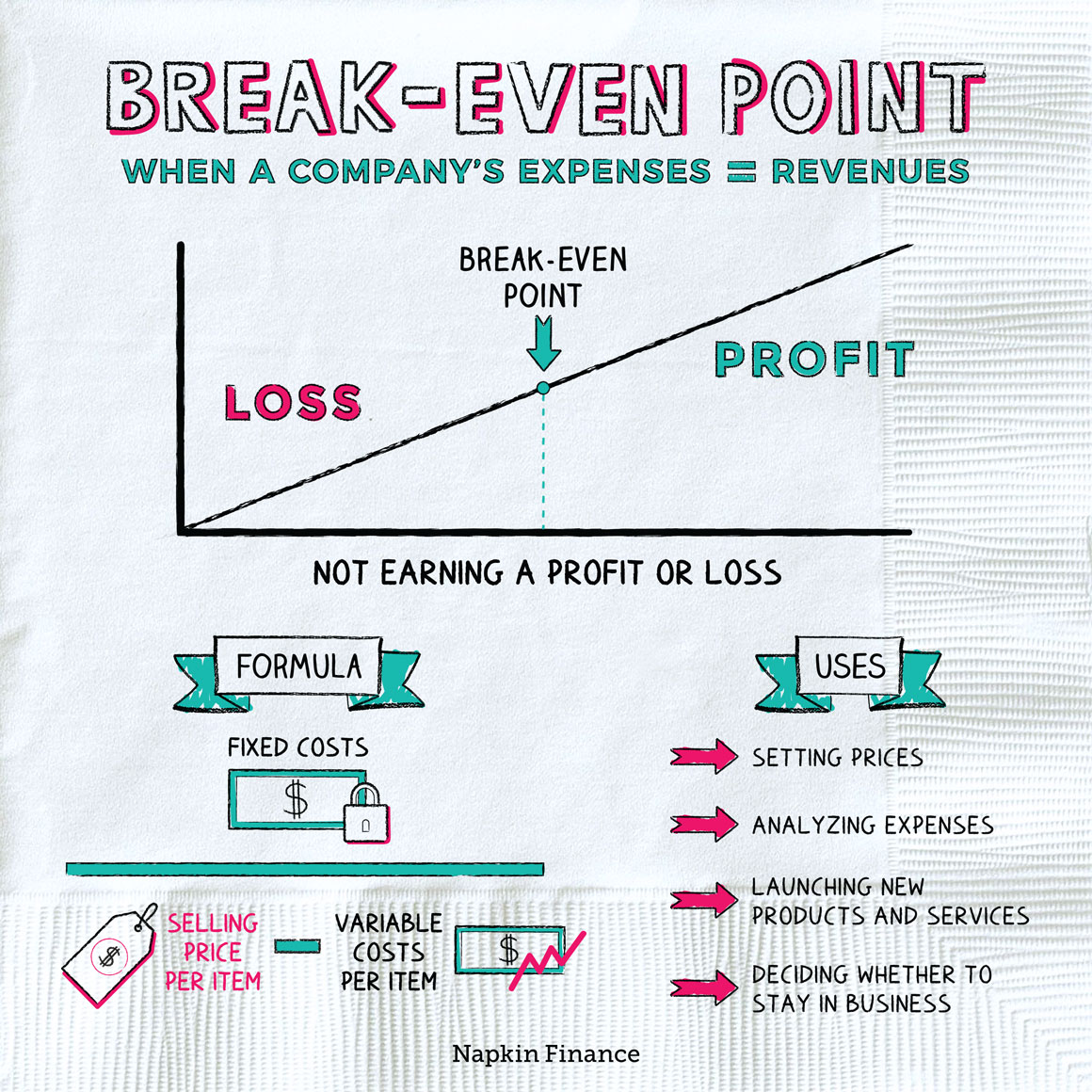

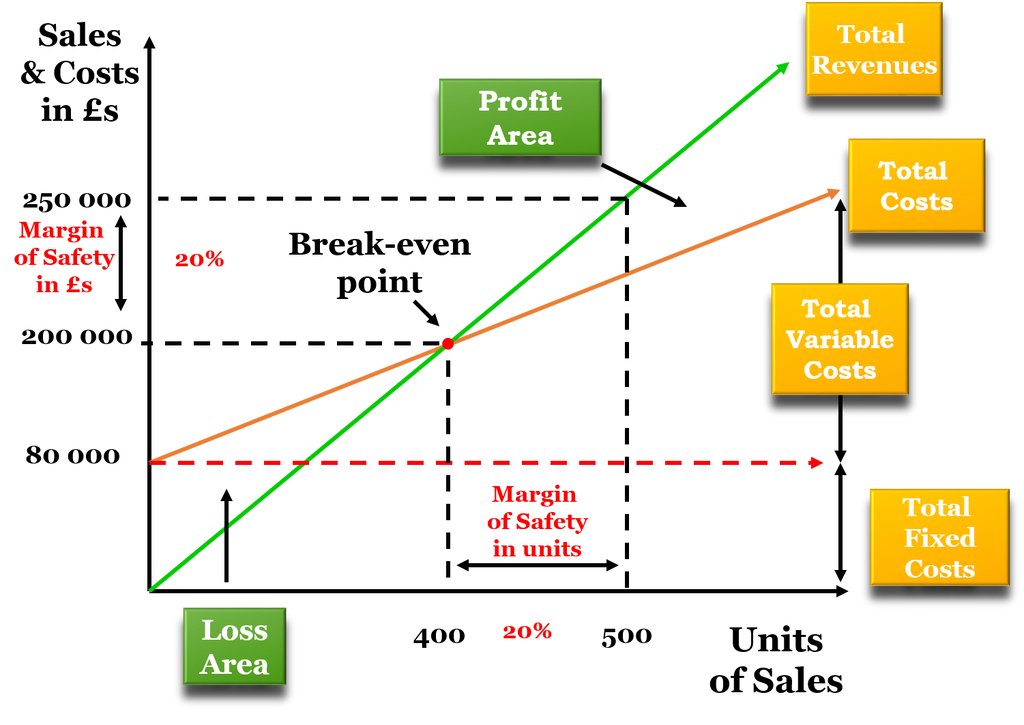

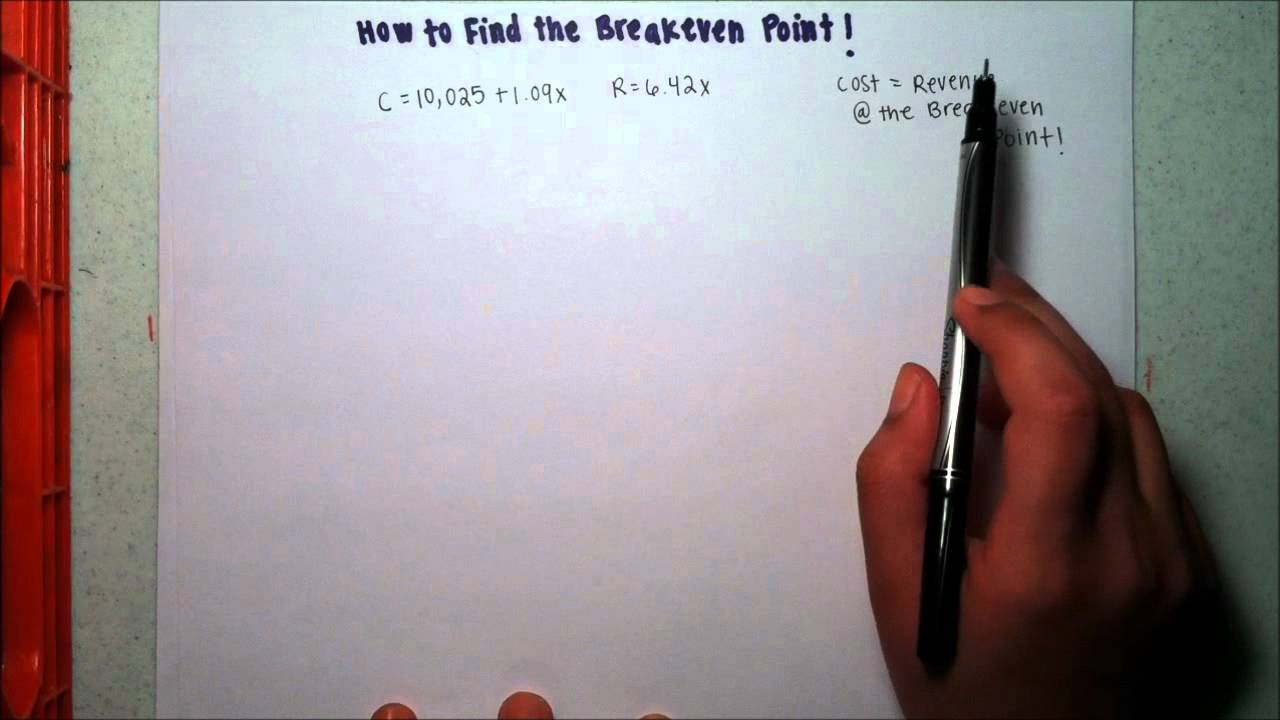

See also How Many Types of Adjustable-rate Mortgages? All You Need To KnowĪ company will need to review its strategy if it earns anything less than the fixed expenditure it has to make.īased on priority scaling, companies usually pay out their interest on loans first, then preferred dividends to their preferred shareholders, and then finally make use of the remains for its equity shareholders and are retained early. Instruments like this come with mandatory payment, which makes up for the company’s fixed cost. Most companies with a mixed capital structure calculate their financial break-even point.Ĭompanies usually have various choices when raising funds, such as bank loans, debentures, preference, equity, etc. Financial break-even concerns itself with the ending section of a company’s income statement. It is also seen as the level that equates the company’s interest expenditure in addition to its associated taxes and the dividend paid to preferred shareholders.Īny earning learning from the company beyond this level is usually considered a profit to its shareholders. Put in another way, it could be seen as the level of EBIT which equates to a fixed financial cost for the company, such cost could be preference dividends, debt interest, and its likes. It is also considered the minimum EBIT (earnings before interest and tax) a company should earn to attain its fixed target. The financial breakeven point is the level of earning before Interest and taxes where the company’s earnings per share equate to zero that is, the company’s net income will equal zero. Here we would base more on financial breakeven. While accounting breakeven concerns the point at which a company is neither making a profit nor a loss, that is a position where the company’s revenue and expenditure equate.įinancial break-even differs in some ways.

Financial breakeven differs from accounting breakeven. The term is used by accounting firms, investment institutes, and companies. Breakeven concerns itself with an entity’s margin of safety.

0 kommentar(er)

0 kommentar(er)